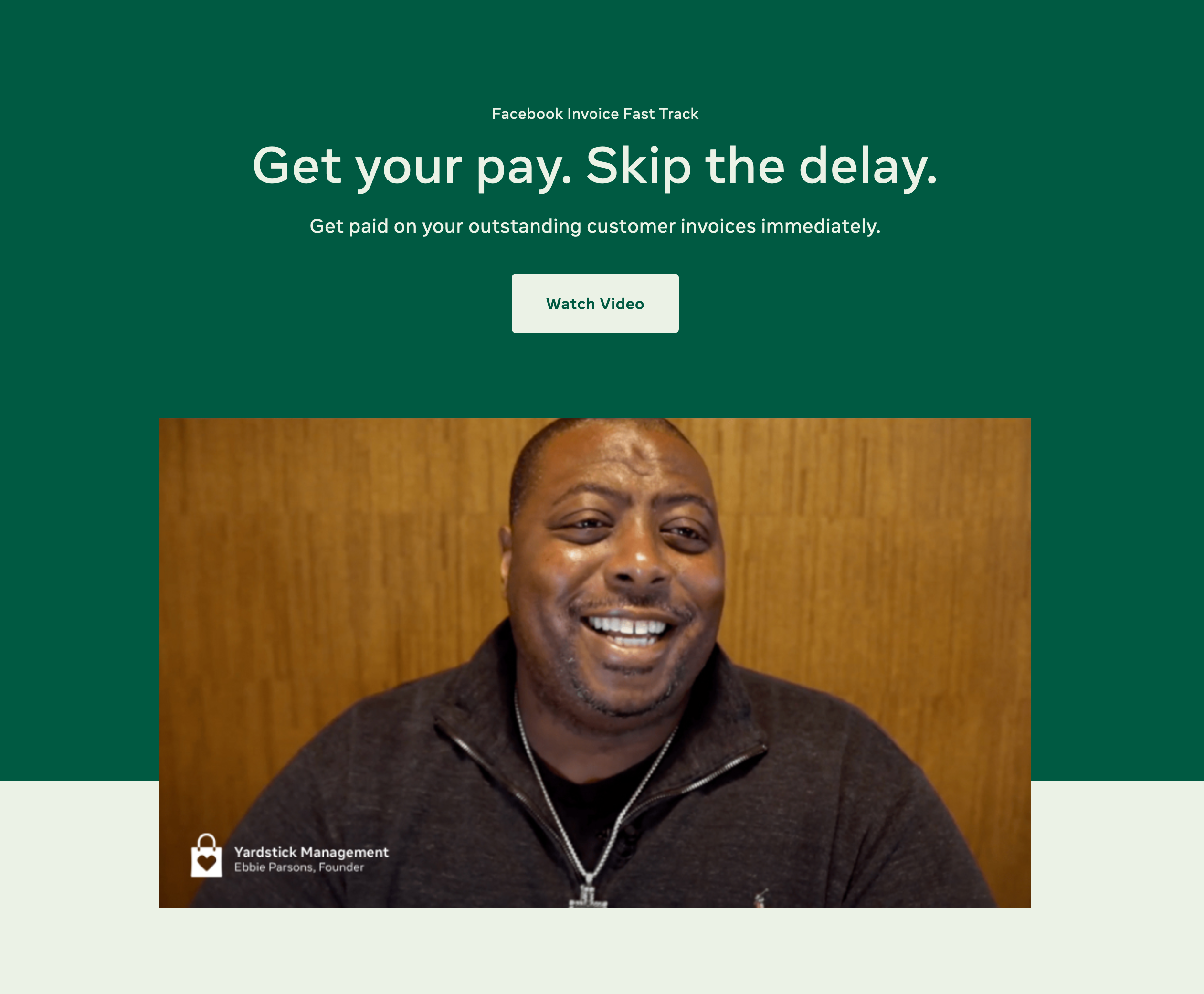

Receivables Financing for Suppliers

Our receivables financing services let you trade your unpaid invoices for cash, eliminating lengthy payment terms and high interest rates.

Supplier Success leverages its lending partnerships and banking relationships to help diverse and growing businesses secure the best funding option for their business.

Whether you’re looking to trade an invoice or want to lower your existing interest rates, we are able to provide you with the immediate, affordable liquidity you need to operate and grow your businesses.

Benefits of receivables financing

What sets us apart

Our experts

Louis Green

Founder & CEO

Louis Green is a nationally known expert in the fields of procurement, supply chain man…